Sustainability

Engineering innovative and forward-thinking solutions, we’re building a better, more sustainable future where energy efficiency drives profitability across a growing range of industries.

22.5 million

Metric tons of carbon emissions avoided by our customers annually

65%

Goal to reduce our emissions in relation to our revenue by 2026

$7.2 billion

Energy expenses saved by our customers annually

100%

of manufacturing facilities adhere to quality, safety, and environmental management systems certified to ISO standards

43.6 million

Cubic meters of water – equivalent to 17,000 Olympic-sized swimming pools-are cleaned each day in facilities with an Energy Recovery ERD

3 new targets

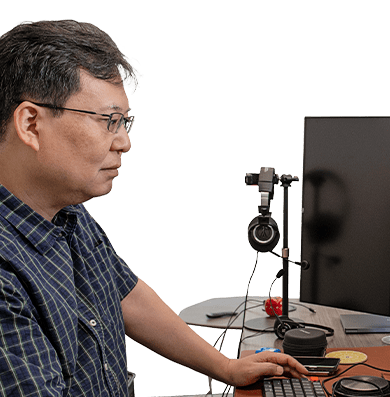

Sustainability in action

Our UNSDG Alignment

Clean Water and Sanitation

Target 6.1, 6.3, 6.4, 6.A

Our energy recovery devices help our water industry customers adapt to climate change by increasing efficiencies for water desalination facilities and reducing costs and emissions. Our energy recovery devices for wastewater treatment applications significantly reduce the energy needs, costs, and emissions associated with treating wastewater discharge via reverse osmosis.

Affordable and Clean Energy

Target 7.3

Our products reduce emissions related to the production of vital resources by increasing efficiency and reducing energy consumption. Our energy recovery solutions save customers 47.4 TWh of energy consumption annually, making energy-intensive industries, such as seawater desalination, wastewater treatment, and CO2 refrigeration affordable and accessible.

Industry, Innovation, and Infrastructure

Target 9.2, 9.4

Our products help build more resilient infrastructure and advance sustainable industrialization by enabling energy and cost-efficient commercial and industrial processes. In the refrigeration sector, the Kigali Amendment has gained significant traction, aligning signatories with specified timelines to phase down HFC use. Our PX G1300® energy recovery device helps our CO2 refrigeration customers save energy, reduce water usage, and increase system stability, improving their bottom line while reducing their carbon footprint, adapting to climate change, and meeting local regulations.

Responsible Consumption and Production

Target 12.2, 12.4-7, 12.A

Our products and solutions are aligned in their focus on the efficient management and use of natural resources. Our product lines in industries such as refrigeration can offer a cost-effective path for transitioning to a more sustainable and natural refrigerant to exponentially reduce greenhouse gas emissions. Furthermore, we are committed to adopting more sustainable consumption and production practices in our own operations.

Climate Action

Target 13.1, 13.2, 13.3

Our product lines reduce energy consumption and greenhouse gas emissions globally and support reuse of wastewater and provision of drinking water to communities. In 2024, our products helped customers avoid 22.5 M metric tons of carbon emissions*. This is equivalent to removing over 5 million cars from the road each year. In our own operations, we have set a target to reduce our greenhouse gas emissions in relation to our revenue by 65% by 2026.

*Based on Energy Recovery estimates (internally validated)

Awards & Ratings

MSCI ESG Rating “AAA”

“Best ESG Communications” and “Best ESG Reporting among small to mid-cap companies”

Sustainalytics ESG Risk Rating: Medium

MSCI ESG Small Cap Leaders Index

As of 2024, Energy Recovery, Inc. received an MSCI ESG Rating of AAA. THE USE BY ENERGY RECOVERY, INC OF ANY MSCI ESG RESEARCH LLC OR ITS AFFILIATES (“MSCI”) DATA, AND THE USE OF MSCI LOGOS, TRADEMARKS, SERVICE MARKS OR INDEX NAMES HEREIN, DO NOT CONSTITUTE A SPONSORSHIP, ENDORSEMENT, RECOMMENDATION, OR PROMOTION OF ENERGY RECOVERY, INC BY MSCI. MSCI SERVICES AND DATA ARE THE PROPERTY OF MSCI OR ITS INFORMATION PROVIDERS, AND ARE PROVIDED ‘AS-IS’ AND WITHOUT WARRANTY. MSCI NAMES AND LOGOS ARE TRADEMARKS OR SERVICE MARKS OF MSCI.

In May 2024, Energy Recovery received an ESG Risk Rating of 24.5 and was assessed by Morningstar Sustainalytics to be at Medium risk of experiencing material financial impacts from ESG factors. In no event shall the rating be construed as investment advice or expert opinion as defined by the applicable legislation. The information contained or reflected herein is not directed to or intended for use or distribution to India-based clients or users and its distribution to Indian resident individuals or entities is not permitted, and Morningstar/Sustainalytics accepts no responsibility or liability whatsoever for the actions of third parties in this respect.

Last Updated: June 2025

For details on data methodology and definitions, please see our most recent annual performance report.